Life Insurance in and around Billings

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Protect Those You Love Most

There's a common misconception that you don't need Life insurance when you're young, but even if you are young and just rented your first place, now could be the right time to start talking about Life insurance.

Get insured for what matters to you

Don't delay your search for Life insurance

Why Billings Chooses State Farm

Life can be just as unforeseeable when you're young as when you get older. That's why there's no time like the present to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for coverage for a specific time frame or coverage for a specific number of years, State Farm can help you choose the right policy for you.

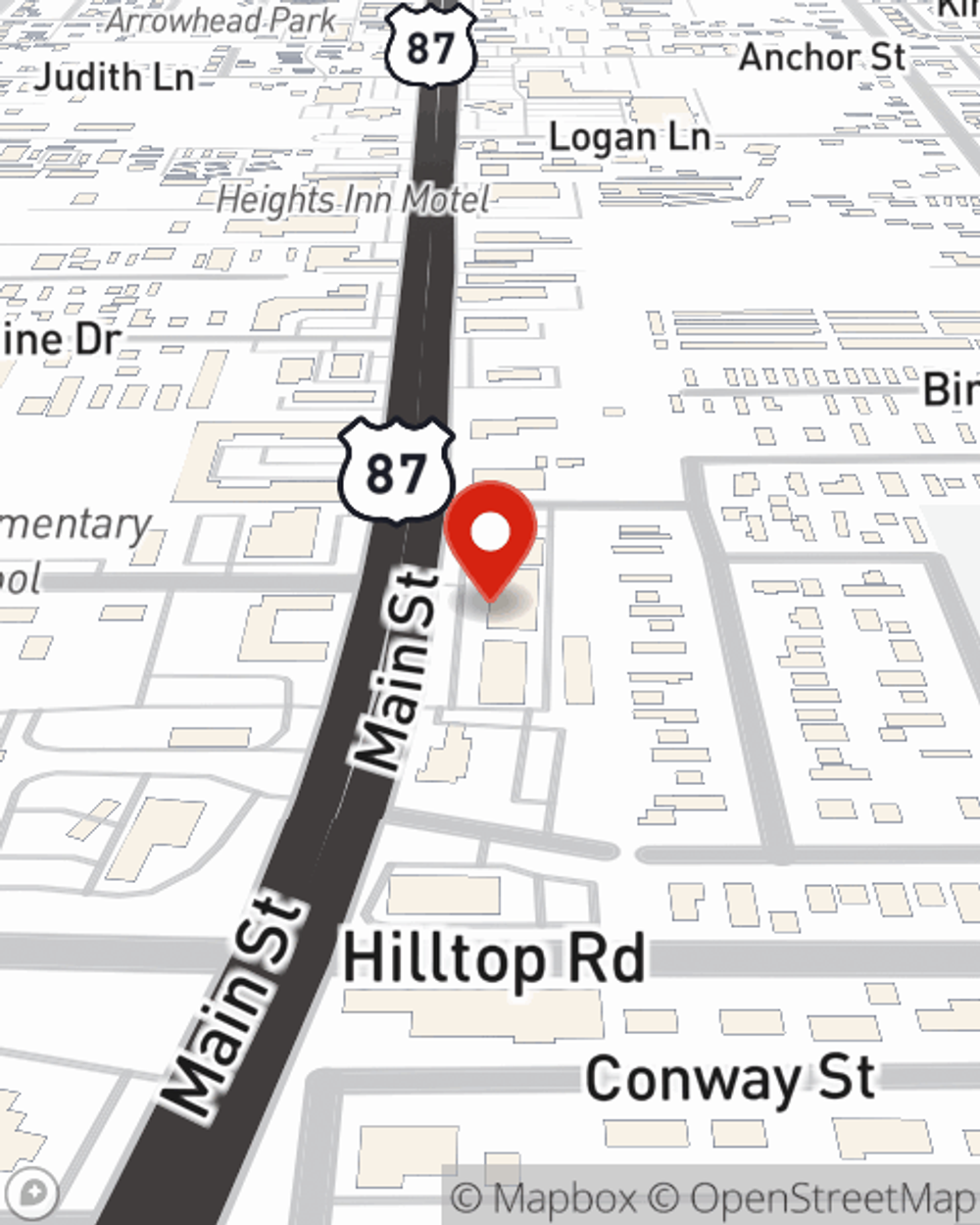

If you're a person, life insurance is for you. Agent Kari Jones would love to help you learn more about the variety of coverage options that State Farm offers and help you get a policy that works for you and your family. Call or email Kari Jones's office to get started.

Have More Questions About Life Insurance?

Call Kari at (406) 248-6556 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Simple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.