Business Insurance in and around Billings

One of Billings’s top choices for small business insurance.

Almost 100 years of helping small businesses

Help Prepare Your Business For The Unexpected.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected damage or catastrophe. And you also want to care for any staff and customers who stumble and fall on your property.

One of Billings’s top choices for small business insurance.

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

No one knows what tomorrow will bring—especially in the business world. Since even your most detailed plans can't predict natural disasters or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your future with coverage like extra liability and a surety or fidelity bond. Fantastic coverage like this is why Billings business owners choose State Farm insurance. State Farm agent Kari Jones can help design a policy for the level of coverage you have in mind. If troubles find you, Kari Jones can be there to help you file your claim and help your business life go right again.

Eager to explore the specific options that may be right for you and your small business? Simply call or email State Farm agent Kari Jones today!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

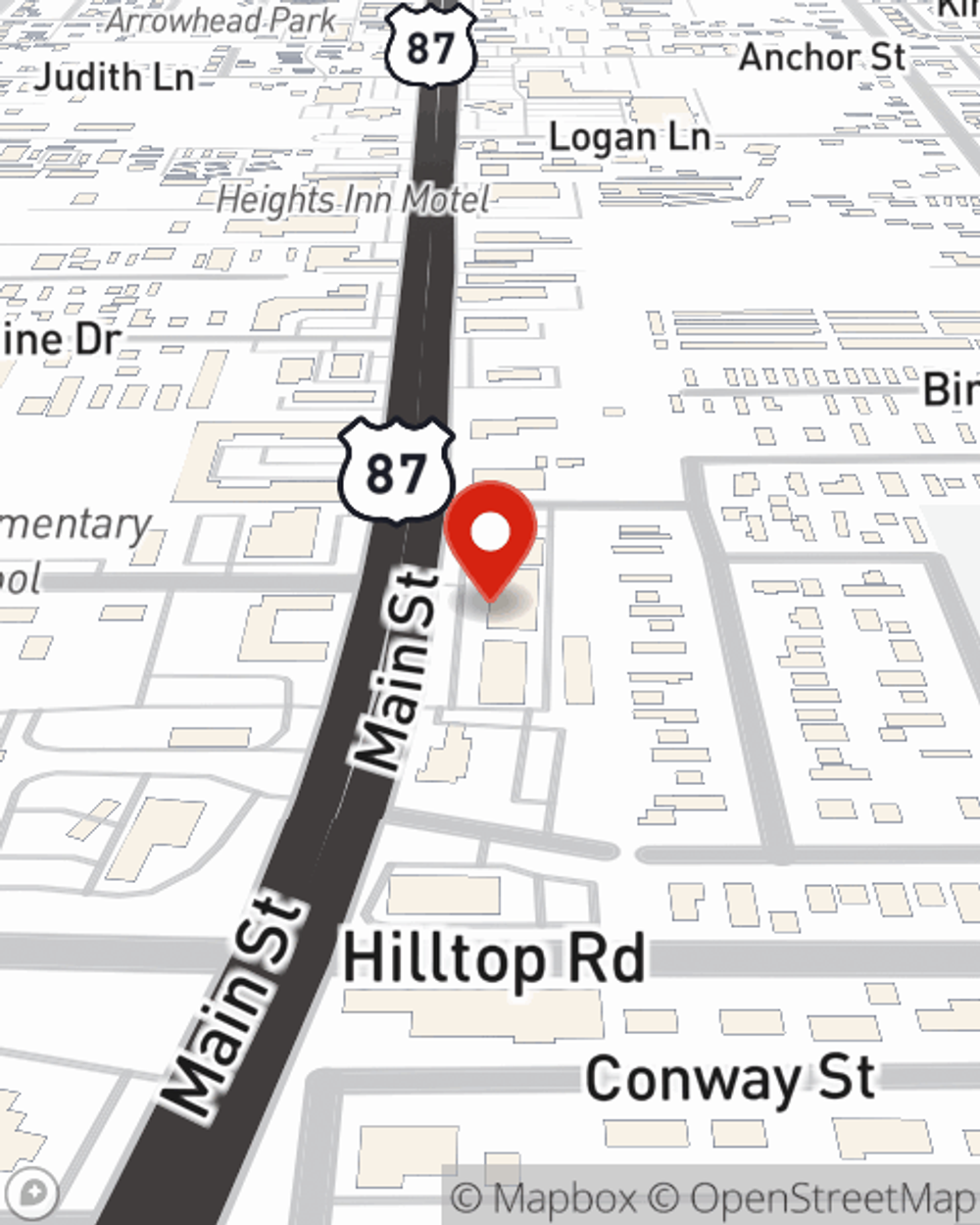

Kari Jones

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.